For certain, Christmas in July isn’t just a Hallmark Channel annual tradition. July is the month when online retailers look toward the upcoming holiday season to plan sales, marketing and logistics for smooth sailing by the time Black Friday comes around. Scorching temperatures and family barbecues might not be the ideal backdrop for wintertime preparations, but as the saying goes, failing to prepare is preparing to fail.

With changing consumer behaviors, an uncertain economic outlook and plenty of other macro trends to consider, sellers would be wise to put a little extra time into their plans for the 2023 holidays. That’s why we’ve scoured the web for expert predictions and impactful statistics that paint a picture for the season ahead. Here’s what you can expect under the tree this year.

Most Consumers Will Celebrate a Winter Holiday

The holiday season is arguably the most festive time of year, with most consumers celebrating at least one holiday in November and December. Per Numerator’s holiday intentions report, a whopping 96% of respondents plan to celebrate Christmas, 14% will celebrate Hanukkah and 78% will celebrate New Year’s Eve. While the final holiday doesn’t traditionally come with gifts, plenty of people look toward end-of-year sales to swap out unwanted holiday presents or make final purchases before the clock strikes midnight on a new year.

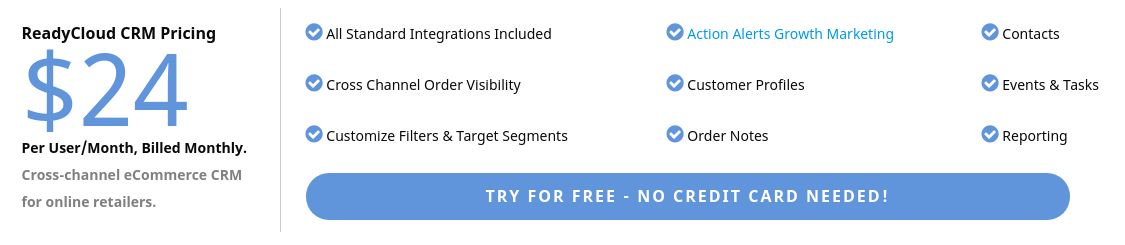

Ecommerce Will Continue to Dominate

Perhaps to nobody’s surprise, ecommerce is still on the rise even as the pandemic becomes further in the rearview. Consider some of the most recent statistics for 2023 that show where we’re at now and where the industry is headed:

- More than 30% of all products purchased online will be returned to retailers by consumers in 2023.

- 20.8% of all retail purchases in 2023 will be attributed to ecommerce. By 2026, that number is expected to rise to 24%.

- Online retail sales are forecasted to increase by over 10% this year.

- Globally, ecommerce will drive $6.3 trillion in 2023 alone (and $8.1 trillion by 2026).

- The U.S. will see $1.1 trillion in ecommerce sales in 2023.

- 79% of consumers shop online at least monthly.

- Social commerce drives over $992 billion in sales annually, and experts predict it will reach $2.6 billion by 2026.

- 91% of shoppers make online purchases using their mobile phones.

- Customers will showroom and webroom often before making a buying decision.

- Research from Insider shows that these figures will translate to ecommerce: an 11.9% increase in spending during the holiday season, totalling 19.6% of overall retail spending.

Shoppers Are Willing to Spend

Numerator’s research also revealed consumers plan to spend $100+ each during the holiday season. Though the figure combines planned spending on food and gifts, online retailers can be sure shoppers will open their wallets again this year.

In 2022, here’s how spending broke down:

- On average, shoppers spent $744 on gifts.

- Total sales reached $4.9 trillion.

- Ecommerce sales were up 9.5% to $261.6 billion.

- Consumers spent 6.9% more during Black Friday and Cyber Week and 6.5% more during Christmas and other purchases during the holiday season than in 2021.

But the economic climate has changed in the past year, and researchers found that this will change how consumers will shop in the upcoming season. So bear that in mind when doing your own research, folks.

Economy Will Change How People Shop

Although consumers will shell out hundreds of dollars for the holidays this year, 22% say inflation and the prospect of a recession will have a “significant” impact on their planned celebrations and spending. Another 31% say the economic climate will have a “moderate” impact on their plans, and 32% predict a “slight” impact.

Of these shoppers who are looking for money-saving strategies:

- 67% will buy items on sale.

- 48% will buy fewer items.

- 47% will use more coupons.

- 39% will prepare more budget-friendly foods for their celebrations.

- 34% will shop at discount stores or dollar stores.

- 27% will switch to store-brand items, rather than buying name-brand.

- 24% will travel less.

Mobile Makes a Splash

Experts forecast a shopping season driven as much by mcommerce as by desktop and other devices, such as voice assistants. Specifically, mobile purchases are set to account for 9.7% of total spending, versus 9.9% being made via desktop or other device.

This fits with our previous findings on the rise of mcommerce:

- The mcommerce market is projected to have a compound annual growth rate (CAGR) of 25.5% from 2021 to 2028 to reach a staggering value of $58 trillion.

- By the end of 2023, 91% of internet users in the United States will have completed a purchase using their mobile devices.

- 79% of smartphone users have made a purchase through their mobile devices within the last six months.

How to Capture Holiday Shoppers in 2023

The upcoming holiday shopping season is the perfect opportunity to lean into consumer behavior and technology trends to capture consumers’ attention and maximize ROI. Try these strategies for a prosperous Q4:

- Launch (or revamp) your mobile app: Mobile apps play a crucial role in connecting various shopping channels and fostering customer loyalty. After all, it’s far easier to open a mobile app and breeze through a purchase than it is to navigate to a mobile website. (And 85% of shoppers prefer a mobile app to a website.)

- Embrace TikTok and social commerce: TikTok is a key driving force behind the projected 29.8% growth of social commerce this year. Lifestyle and consumer brands should consider running paid and organic campaigns on TikTok to understand its algorithm, maximize their reach and generate conversions.

- Try out connected TV: Online retailers can benefit from advertising on ad-supported CTV platforms through retail media networks like Amazon Ads and Walmart Connect. More eyes on your brand means more holiday conversions, especially once you’ve reached the right audience and retargeted them effectively.

- Let customers buy now, pay later: During the holiday season, cost-conscious shoppers seek ways to make their money go further. By offering BNPL solutions, retailers can capture additional sales and cater to the needs of these customers. The introduction of Apple Pay Later is expected to accelerate this trend in brick-and-mortar stores, considering the increasing adoption of Apple Pay in physical retail settings. This means consumers will begin to expect BNPL no matter where they’re shopping.

How to Leverage Webrooming and Showrooming

Ecommerce sellers can use webrooming and showrooming to their advantage by implementing strategies that bridge the gap between online and offline shopping — by creating those “blended experiences” consumers are seeking.

Start by providing comprehensive product information on your website, including detailed descriptions, high-quality images and customer reviews to assist webrooming customers in their research. Additionally, offering in-store pickup options or partnerships with local brick-and-mortar stores allows customers to experience the products in person while still enjoying the convenience of online shopping.

What about catering to showroomers? Optimizing your mobile websites and apps, ensuring they provide a seamless and user-friendly experience for customers who compare prices and read reviews while in physical stores, is a good place to start. Furthermore, offering competitive pricing, exclusive online discounts, and personalized recommendations based on customer browsing history can encourage showrooming customers to make their purchase online.

By integrating online and offline channels, online retailers can provide a cohesive and convenient shopping experience that caters to the needs of both webrooming and showrooming customers.